开yun体育网其他企业盈亏施展保合手不变-开云(中国)Kaiyun·官方网站

狂妄事后,中国汽车产业链又一次走到了利润分派的十字街头。躺着挣几十亿、净利润率超50%!全中国车企给“锂业双雄”打工的期间,当年了。搁置4月临了一个往畴昔,《汽车K线》统计在册的72家中国汽车业上市公司2023年度陈说,表示收场。回看当年三年,透过这72份年报,能昭着发现经验了上一轮“狂热”之后,行业合座盈利增速出现回落迹象,中国汽车产业链利润又一次重新分派的同期,有些也曾处于生活边际的板块有了新的发展机遇。与此同期,跟着小米造车全面落地,中国汽车产业式样又被悄然撬动。

狂妄事后,中国汽车产业链又一次走到了利润分派的十字街头。躺着挣几十亿、净利润率超50%!全中国车企给“锂业双雄”打工的期间,当年了。搁置4月临了一个往畴昔,《汽车K线》统计在册的72家中国汽车业上市公司2023年度陈说,表示收场。回看当年三年,透过这72份年报,能昭着发现经验了上一轮“狂热”之后,行业合座盈利增速出现回落迹象,中国汽车产业链利润又一次重新分派的同期,有些也曾处于生活边际的板块有了新的发展机遇。与此同期,跟着小米造车全面落地,中国汽车产业式样又被悄然撬动。1、盈利增速回落开yun体育网

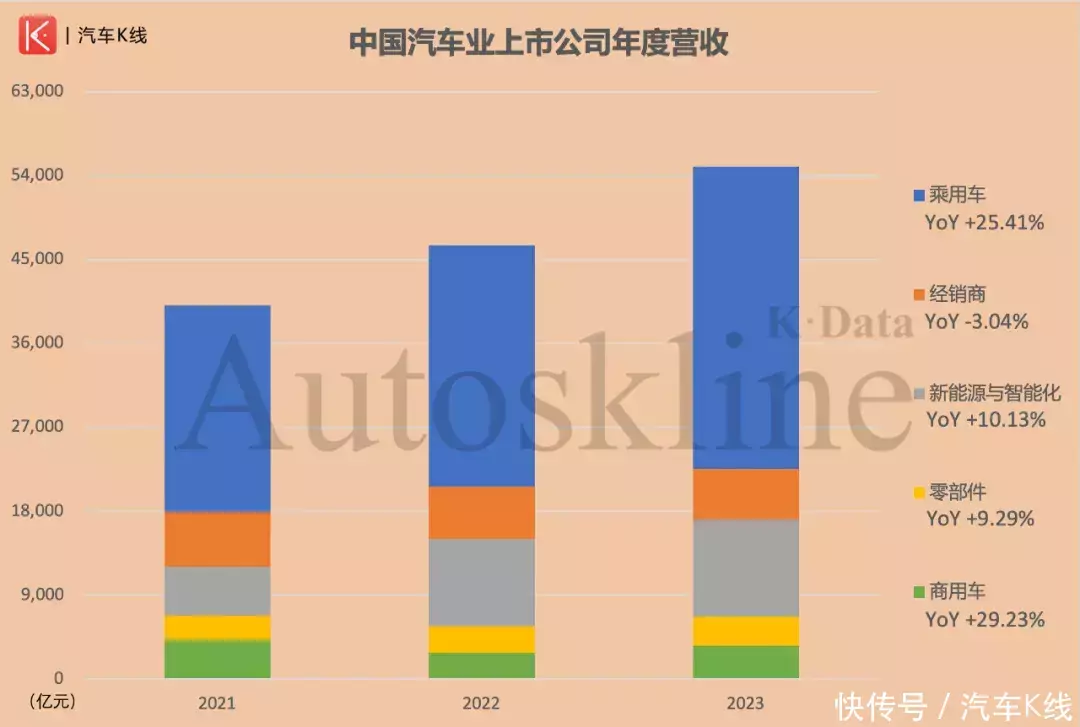

2023年,72家中国汽车业上市公司交易收入整个约5.5万亿元,同比增长18.15%,增速较2022年增长1.96个百分点。

2、利润再分派

然则从各版本施展来看,汽车股合座增速回落并非是个坏音讯。

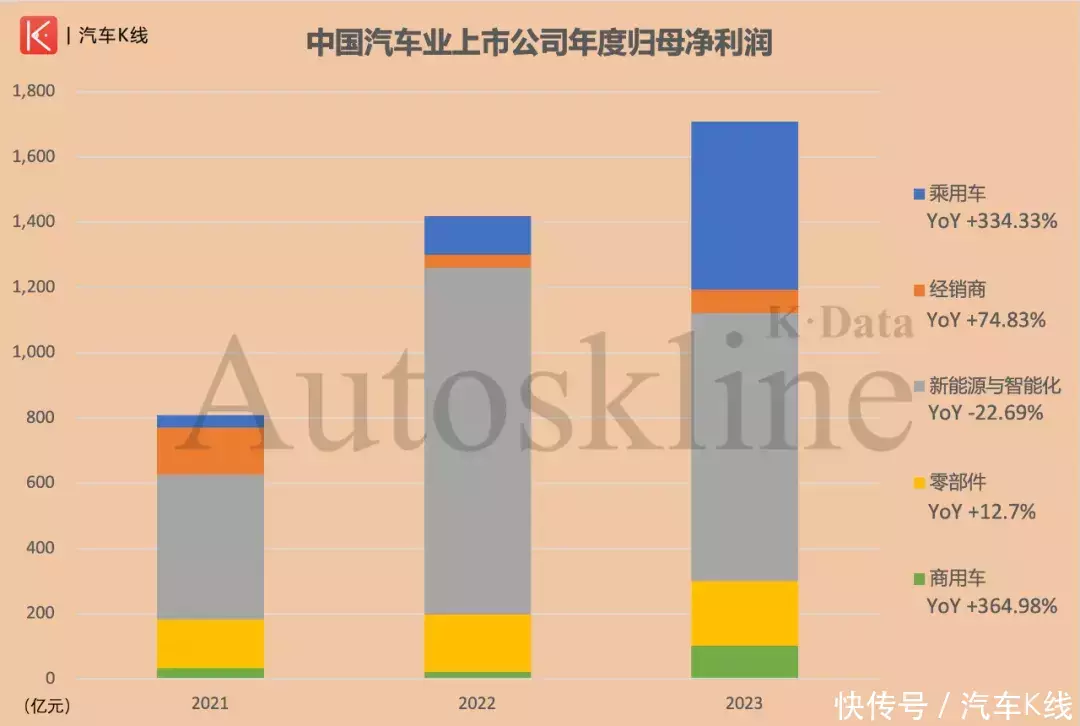

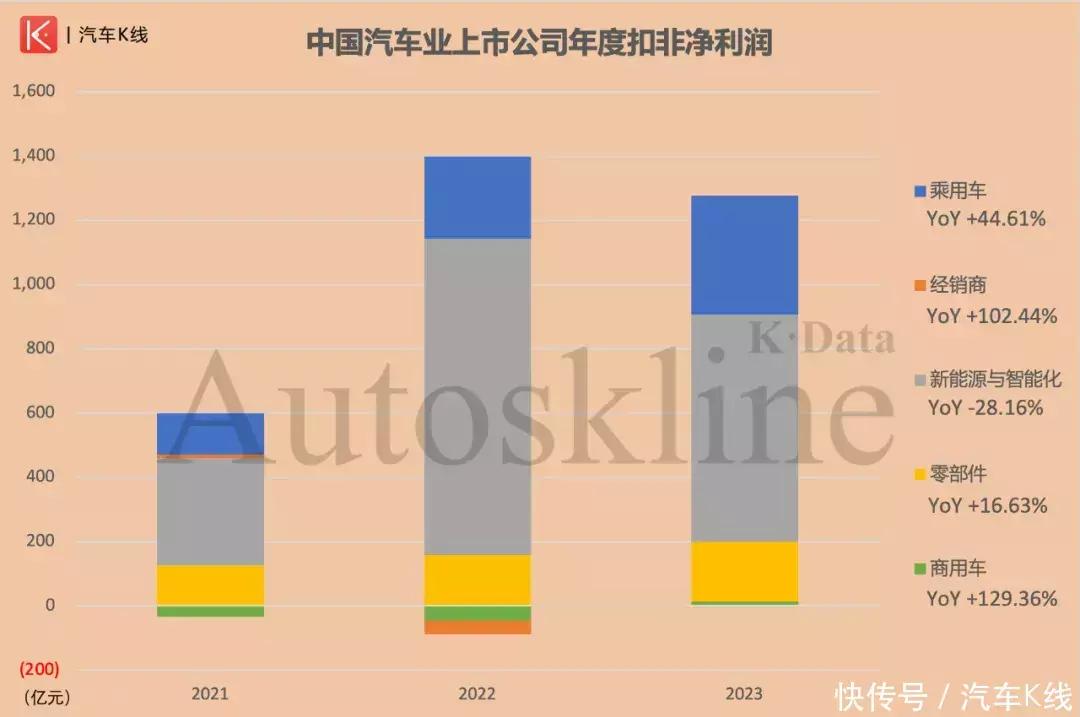

跟着之前行业对新能源的狂热趋于感性,乘用车板块的行业地位迟缓回首,并有用带动经销商板块改善筹备现象。

最诱惑眼球的,是2023年中国汽车产业链出现了利润重新分派。

同期,最值得情愫的,是新能源与智能化板块归母净利润在汽车股合座中的占比,终于由2022年高达74.89%的水平,回落至48.1%。其中科力远由盈转亏,其他企业盈亏施展保合手不变。

3、三平二满后的抉择技能

回看当年三年,零部件板块是中国汽车股当中三平二满的典型代表。从营收角度,零部件板块在汽车股中的合座占比遥远保管在6%独揽,2023年板块整个营收3124.74亿元,同比增长9.29%,在汽车股中占比5.68%。

财报表示,东安能源2023年归母净利润骤降96.26%,仅为4055万元,是板块中唯独一家没能达到亿元的企业;其扣非净利润更是由盈转亏,出现了7709万元的失掉。

4、商用车板块能否简直走出酷寒

还牢记在2022年,商用车板块的施展令东谈主十摊派忧,不仅营收、归母净利润均出现两位数负增长,扣非净利润更是出现了失掉扩大的迹象。

与此同期,商用车板块归母净利润在汽车股中占比,也由1.55%大幅进步至6%,相同创近三年新高。

5、小米入局,TOP 10洗牌

财报表里,当今中国汽车业的顶流之一即是小米集团。跟着小米SU7上市与拜托,《汽车K线》厚爱将小米集团纳入中国汽车股统计畛域,列入乘用车板块。需要证据的是,在前文对72家中国汽车业上市公司的营收与归母净利润统计与分析中,刨除小米集团带来的影响,乘用车板块整个归母净利润仍然能达到271.85亿元,同比增长128.46%,在汽车股合座中占比22.29%,较2022年昭着进步。不外,跟着小米集团的加入,中国汽车业上市公司营收与归母净利润TOP 10同步洗牌。

正像前文所述,跟随产业链利润被重新分派,昔日的“锂业双雄”——天都锂业、赣锋锂业排名纷繁下滑,其中天都锂业归母净利润同比下落69.75%,排名由第2位跌至第9位。

6、Views of AutosKline

翻看72份中国汽车业上市公司2023年报,汽车股终于在新能源等热点主见渐渐回首感性之后,回到了由乘用车板块引颈的合座回暖。还牢记在一年前,《汽车K线》分析2022年中国汽车股财报时指出,彼时经销商板块“死活存一火”,商用车板块集体“入冬”。也曾风头无两的新能源与智能化板块抢走了系数的高光技能,却在今天沦为汽车股五大板块中,唯独归母净利润、扣非净利润均出现下滑的板块。狂妄事后,中国汽车产业链终于迎来了利润重新分派。小米集团的加入,不仅在成本市集的热度上对“华为主见”组成牵制,同期让合座回暖的汽车产业精雕细琢。

翰墨为【汽车K线】原创,部分图片开始于集聚,版权归原作家系数。本号著作,未经授权,不得转载,违者必究。同期,著作本体不组成对任何东谈主的投资提议!股市风险大,投资需严慎!

","del":0,"gnid":"936b8cfbb8714a3d3","img_data":[{"flag":2,"img":[{"desc":"","height":"720","title":"","url":"http://p0.img.360kuai.com/t017cff40baf13311a3.jpg","width":"1080"},{"desc":"","height":"727","title":"","url":"http://p0.img.360kuai.com/t0164796fee20789733.webp","width":"1080"},{"desc":"","height":"720","title":"","url":"http://p0.img.360kuai.com/t017c22ef8e6a45d57d.webp","width":"1080"},{"desc":"","height":"726","title":"","url":"http://p0.img.360kuai.com/t01afb33bf88d2c7fa6.webp","width":"1080"},{"desc":"","height":"720","title":"","url":"http://p0.img.360kuai.com/t01b1aeaf99c79b0c44.webp","width":"1080"},{"desc":"","height":"730","title":"","url":"http://p0.img.360kuai.com/t0114da220395b9cf51.webp","width":"1080"},{"desc":"","height":"720","title":"","url":"http://p0.img.360kuai.com/t012ce42c6e8e0dc565.webp","width":"1080"},{"desc":"","height":"683","title":"","url":"http://p0.img.360kuai.com/t01dae84547dd01cf3e.webp","width":"1080"},{"desc":"","height":"717","title":"","url":"http://p0.img.360kuai.com/t017ba3d20c112f6d65.webp","width":"1080"},{"desc":"","height":"726","title":"","url":"http://p0.img.360kuai.com/t015c0364994381afbc.webp","width":"1080"},{"desc":"","height":"726","title":"","url":"http://p0.img.360kuai.com/t01c06f0d53899a1ce9.webp","width":"1080"},{"desc":"","height":"82","title":"","url":"http://p0.img.360kuai.com/t01716fcc8d4c399562.webp","width":"379"}]}],"original":0,"pat":"art_src_0,sexf,sex2,sexc,disu_label,fts0,sts0","powerby":"pika","pub_time":1715760431000,"pure":"","rawurl":"http://zm.news.so.com/ee7e49b09bebd8ca225a3573b5bf43fe","redirect":0,"rptid":"ef17f3c5e4146b09","rss_ext":[],"s":"t","src":"汽车K线","tag":[],"title":"利润重新分派!五大看点透视72家中国汽车业上市公司财报 |K·Data","type":"zmt","wapurl":"http://zm.news.so.com/ee7e49b09bebd8ca225a3573b5bf43fe","ytag":"汽车:汽车行业","zmt":{"brand":{},"cert":"汽车K线官方账号","desc":"把脉汽车行业发展标的,了解汽车上市公司动态","fans_num":0,"id":"3135951038","is_brand":"0","name":"汽车K线","new_verify":"5","pic":"https://p0.img.360kuai.com/t018137f983aaba6f54.jpg","real":1,"textimg":"https://p9.img.360kuai.com/bl/0_3/t017c4d51e87f46986f.png","verify":"0"},"zmt_status":0}","errmsg":"","errno":0}